00018110742024FYfalse1221850.06250.06250.00781250.06250.00781250.1250.06250.0078125http://fasb.org/us-gaap/2024#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2024#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2024#NonoperatingIncomeExpense.33.33.33iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:acretpl:financialInstitutionutr:Hutr:Boeutr:MMBblsutr:MMcfiso4217:USDtpl:barrel00018110742024-01-012024-12-3100018110742024-06-3000018110742025-02-1200018110742024-10-012024-12-310001811074tpl:MurrayStahlMember2024-01-012024-12-310001811074tpl:MurrayStahlMember2024-10-012024-12-310001811074tpl:MurrayStahlMember2024-12-310001811074tpl:ChrisSteddumMember2024-01-012024-12-310001811074tpl:ChrisSteddumMember2024-10-012024-12-310001811074tpl:ChrisSteddumMember2024-12-3100018110742024-12-3100018110742023-12-310001811074tpl:LandSurfaceRightsMember2024-12-310001811074tpl:LandSurfaceRightsMember2023-12-310001811074tpl:RoyaltyInterestsInAcres1_16And1_128Member2024-12-310001811074tpl:RoyaltyInterestsInAcres1_16And1_128Member2023-12-310001811074tpl:RoyaltyInterestsInAcres116Member2024-01-012024-12-310001811074tpl:RoyaltyInterestsInAcres116Member2023-01-012023-12-310001811074tpl:RoyaltyInterestsInAcres128Member2023-01-012023-12-310001811074tpl:OilAndGasRoyaltiesMember2024-01-012024-12-310001811074tpl:OilAndGasRoyaltiesMember2023-01-012023-12-310001811074tpl:OilAndGasRoyaltiesMember2022-01-012022-12-310001811074tpl:WaterSalesAndRoyaltiesMember2024-01-012024-12-310001811074tpl:WaterSalesAndRoyaltiesMember2023-01-012023-12-310001811074tpl:WaterSalesAndRoyaltiesMember2022-01-012022-12-310001811074tpl:ProducedWaterRoyaltiesMember2024-01-012024-12-310001811074tpl:ProducedWaterRoyaltiesMember2023-01-012023-12-310001811074tpl:ProducedWaterRoyaltiesMember2022-01-012022-12-310001811074tpl:EasementandSundryMember2024-01-012024-12-310001811074tpl:EasementandSundryMember2023-01-012023-12-310001811074tpl:EasementandSundryMember2022-01-012022-12-310001811074tpl:LandSalesMember2024-01-012024-12-310001811074tpl:LandSalesMember2023-01-012023-12-310001811074tpl:LandSalesMember2022-01-012022-12-3100018110742023-01-012023-12-3100018110742022-01-012022-12-310001811074us-gaap:CommonStockMember2021-12-310001811074us-gaap:TreasuryStockCommonMember2021-12-310001811074us-gaap:AdditionalPaidInCapitalMember2021-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001811074us-gaap:RetainedEarningsMember2021-12-3100018110742021-12-310001811074us-gaap:RetainedEarningsMember2022-01-012022-12-310001811074us-gaap:CommonStockMember2022-01-012022-12-310001811074us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001811074tpl:O2022ADividendsMember2022-01-012022-12-310001811074tpl:S2022ADividendsMember2022-01-012022-12-310001811074us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001811074us-gaap:CommonStockMember2022-12-310001811074us-gaap:TreasuryStockCommonMember2022-12-310001811074us-gaap:AdditionalPaidInCapitalMember2022-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001811074us-gaap:RetainedEarningsMember2022-12-3100018110742022-12-310001811074us-gaap:RetainedEarningsMember2023-01-012023-12-310001811074us-gaap:CommonStockMember2023-01-012023-12-310001811074us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001811074us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001811074us-gaap:CommonStockMember2023-12-310001811074us-gaap:TreasuryStockCommonMember2023-12-310001811074us-gaap:AdditionalPaidInCapitalMember2023-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001811074us-gaap:RetainedEarningsMember2023-12-310001811074us-gaap:RetainedEarningsMember2024-01-012024-12-310001811074us-gaap:CommonStockMember2024-01-012024-12-310001811074us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001811074us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001811074tpl:O2024ADividendsMember2024-01-012024-12-310001811074tpl:S2024ADividendsMember2024-01-012024-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001811074us-gaap:CommonStockMember2024-12-310001811074us-gaap:TreasuryStockCommonMember2024-12-310001811074us-gaap:AdditionalPaidInCapitalMember2024-12-310001811074us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001811074us-gaap:RetainedEarningsMember2024-12-310001811074tpl:WestTexasMember2024-12-310001811074tpl:WestTexasMembertpl:A1128thNonparticipatingPerpetualOilAndGasRoyaltyInterestMember2024-12-310001811074tpl:WestTexasMembertpl:A116thNonparticipatingPerpetualOilAndGasRoyaltyInterestMember2024-12-310001811074tpl:WestTexasMembertpl:A18thNetRoyaltyAcresMember2024-12-310001811074tpl:WestTexasMembertpl:NetRoyaltyAcresMember2024-12-310001811074tpl:RoyaltyInterestsInAcres1_16And1_128Member2024-01-012024-12-310001811074tpl:RoyaltyInterestsInAcres128Member2024-01-012024-12-310001811074tpl:A18thNetRoyaltyAcresMember2024-01-012024-12-310001811074us-gaap:LandMember2024-12-310001811074tpl:OilAndGasRoyaltiesMember2024-12-310001811074tpl:OilAndGasRoyaltiesMember2023-12-310001811074srt:MinimumMember2024-12-310001811074srt:MaximumMember2024-12-310001811074srt:MinimumMembertpl:FencingWaterWellsAndWaterWellFieldsMember2024-12-310001811074srt:MaximumMembertpl:FencingWaterWellsAndWaterWellFieldsMember2024-12-310001811074srt:MinimumMembertpl:OfficeFurnitureEquipmentAndVehiclesMember2024-12-310001811074srt:MaximumMembertpl:OfficeFurnitureEquipmentAndVehiclesMember2024-12-310001811074us-gaap:CustomerConcentrationRiskMemberus-gaap:CashAndCashEquivalentsMember2024-01-012024-12-310001811074tpl:SignificantCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001811074tpl:SignificantCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001811074tpl:SignificantCustomersMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001811074tpl:AcquiredAssetsMemberstpr:TXtpl:LandAcquisitionsMember2024-08-200001811074tpl:AcquiredAssetsMember2024-08-202024-08-200001811074tpl:AcquiredAssetsMember2024-12-310001811074tpl:AcquiredAssetsMember2024-01-012024-12-310001811074tpl:AcquiredAssetsMembertpl:ProducedWaterRoyaltiesMember2024-01-012024-12-310001811074tpl:AcquiredAssetsMemberus-gaap:LeaseAgreementsMember2024-08-200001811074tpl:AcquiredAssetsMember2024-08-202024-12-310001811074tpl:RoyaltyInterestsInAcres128Member2024-12-310001811074tpl:RoyaltyInterestsInAcres128Member2023-12-310001811074tpl:RoyaltyInterestsMember2024-12-310001811074tpl:RoyaltyInterestsMember2023-12-310001811074tpl:AdditionalRealEstateAcquisitionsMember2024-12-310001811074tpl:AdditionalRealEstateAcquisitionsMember2024-01-012024-12-310001811074tpl:AdditionalRealEstateAcquisitionsMember2024-08-310001811074tpl:AdditionalRealEstateAcquisitionsMember2024-08-012024-08-3100018110742024-08-310001811074tpl:AdditionalRealEstateAcquisitionsMember2024-10-310001811074tpl:NRALocationsInMidlandMember2024-10-310001811074tpl:NRALocationsInMidlandMember2024-10-022024-10-0200018110742024-10-310001811074tpl:AdditionalRealEstateAcquisitionsMember2023-12-310001811074tpl:AdditionalRealEstateAcquisitionsMember2023-01-012023-12-310001811074tpl:LandAcquisitionsMember2024-01-012024-12-310001811074stpr:TXtpl:LandAcquisitionsMember2023-01-012023-12-310001811074stpr:TXtpl:LandSalesMember2024-01-012024-12-310001811074stpr:TXtpl:LandSalesMember2023-01-012023-12-310001811074stpr:TXtpl:LandSalesMember2022-01-012022-12-310001811074tpl:WaterServicerelatedAssetsMember2024-12-310001811074tpl:WaterServicerelatedAssetsMember2023-12-310001811074us-gaap:FurnitureAndFixturesMember2024-12-310001811074us-gaap:FurnitureAndFixturesMember2023-12-310001811074us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-12-310001811074us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310001811074tpl:SaltwaterDisposableEasementMember2024-12-310001811074tpl:SaltwaterDisposableEasementMember2023-12-310001811074tpl:ContractsAcquiredInBusinessCombinationMember2024-12-310001811074tpl:ContractsAcquiredInBusinessCombinationMember2023-12-310001811074tpl:GroundwaterRightsMember2024-12-310001811074tpl:GroundwaterRightsMember2023-12-310001811074us-gaap:FixedIncomeSecuritiesMember2024-01-012024-12-310001811074us-gaap:EquitySecuritiesMember2024-01-012024-12-310001811074tpl:InflationRateMember2024-01-012024-12-310001811074srt:MinimumMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310001811074srt:MaximumMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310001811074srt:MinimumMemberus-gaap:EquitySecuritiesMember2024-12-310001811074srt:MaximumMemberus-gaap:EquitySecuritiesMember2024-12-310001811074us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310001811074us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001811074us-gaap:DefinedBenefitPlanEquitySecuritiesMember2024-12-310001811074us-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310001811074us-gaap:EquityFundsMember2024-12-310001811074us-gaap:EquityFundsMember2023-12-310001811074us-gaap:FixedIncomeFundsMember2024-12-310001811074us-gaap:FixedIncomeFundsMember2023-12-310001811074us-gaap:TaxableMunicipalBondsMember2024-12-310001811074us-gaap:TaxableMunicipalBondsMember2023-12-3100018110742024-03-262024-03-260001811074us-gaap:PerformanceSharesMember2021-01-012021-12-310001811074us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-12-310001811074us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-12-310001811074us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:CommonStockMembertpl:EmployeeMembersrt:MaximumMember2024-12-310001811074us-gaap:CommonStockMember2024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockMembertpl:EmployeeMember2023-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembertpl:EmployeeMember2023-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockMembertpl:EmployeeMember2022-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembertpl:EmployeeMember2022-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockMembertpl:EmployeeMember2024-01-012024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembertpl:EmployeeMember2024-01-012024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockMembertpl:EmployeeMember2023-01-012023-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembertpl:EmployeeMember2023-01-012023-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockMembertpl:EmployeeMember2024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMembertpl:EmployeeMember2024-12-310001811074us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMembertpl:RestrictedStockAwardsAndRestrictedStockUnitsMembertpl:EmployeeMember2024-01-012024-12-310001811074tpl:TexasPacificLandCorporation2021IncentivePlanMembertpl:RestrictedStockAwardsAndRestrictedStockUnitsMembertpl:EmployeeMember2023-01-012023-12-310001811074us-gaap:PerformanceSharesMember2023-12-310001811074us-gaap:PerformanceSharesMember2022-12-310001811074us-gaap:PerformanceSharesMember2024-01-012024-12-310001811074us-gaap:PerformanceSharesMember2023-01-012023-12-310001811074us-gaap:PerformanceSharesMember2024-12-310001811074us-gaap:PerformanceSharesMembertpl:RelativeTotalStockholderReturnMember2024-01-012024-01-010001811074us-gaap:PerformanceSharesMembertpl:FreeCashFlowMember2024-01-012024-01-010001811074us-gaap:PerformanceSharesMember2024-01-012024-01-010001811074us-gaap:PerformanceSharesMembertpl:RelativeTotalStockholderReturnMember2024-02-132024-02-130001811074us-gaap:PerformanceSharesMembertpl:RelativeTotalStockholderReturnMember2024-02-130001811074us-gaap:PerformanceSharesMembertpl:FreeCashFlowMember2024-02-132024-02-130001811074us-gaap:PerformanceSharesMembertpl:FreeCashFlowMember2024-02-130001811074us-gaap:PerformanceSharesMember2024-02-132024-02-130001811074us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-12-310001811074us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:CommonStockMembersrt:DirectorMembersrt:MaximumMember2024-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:CommonStockMembersrt:DirectorMember2024-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:RestrictedStockMembersrt:DirectorMember2023-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:RestrictedStockMembersrt:DirectorMember2022-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:RestrictedStockMembersrt:DirectorMember2024-01-012024-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:RestrictedStockMembersrt:DirectorMember2023-01-012023-12-310001811074tpl:NonEmployeeDirectorAndDeferredCompensationPlanMemberus-gaap:RestrictedStockMembersrt:DirectorMember2024-12-310001811074tpl:LaborAndRelatedExpenseMember2024-01-012024-12-310001811074tpl:LaborAndRelatedExpenseMember2023-01-012023-12-310001811074tpl:LaborAndRelatedExpenseMember2022-01-012022-12-310001811074us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001811074us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001811074us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001811074stpr:TX2024-12-310001811074stpr:TX2023-12-3100018110742024-03-0100018110742024-03-2600018110742022-11-010001811074tpl:OilAndGasRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2024-01-012024-12-310001811074tpl:OilAndGasRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2024-01-012024-12-310001811074tpl:OilAndGasRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2023-01-012023-12-310001811074tpl:OilAndGasRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2023-01-012023-12-310001811074tpl:OilAndGasRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2022-01-012022-12-310001811074tpl:OilAndGasRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2022-01-012022-12-310001811074tpl:WaterSalesAndRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2024-01-012024-12-310001811074tpl:WaterSalesAndRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2024-01-012024-12-310001811074tpl:WaterSalesAndRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2023-01-012023-12-310001811074tpl:WaterSalesAndRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2023-01-012023-12-310001811074tpl:WaterSalesAndRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2022-01-012022-12-310001811074tpl:WaterSalesAndRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2022-01-012022-12-310001811074tpl:ProducedWaterRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2024-01-012024-12-310001811074tpl:ProducedWaterRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2024-01-012024-12-310001811074tpl:ProducedWaterRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2023-01-012023-12-310001811074tpl:ProducedWaterRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2023-01-012023-12-310001811074tpl:ProducedWaterRoyaltiesMembertpl:LandAndResourceManagementSegmentMember2022-01-012022-12-310001811074tpl:ProducedWaterRoyaltiesMembertpl:WaterServiceandOperationsSegmentMember2022-01-012022-12-310001811074tpl:EasementandSundryMembertpl:LandAndResourceManagementSegmentMember2024-01-012024-12-310001811074tpl:EasementandSundryMembertpl:WaterServiceandOperationsSegmentMember2024-01-012024-12-310001811074tpl:EasementandSundryMembertpl:LandAndResourceManagementSegmentMember2023-01-012023-12-310001811074tpl:EasementandSundryMembertpl:WaterServiceandOperationsSegmentMember2023-01-012023-12-310001811074tpl:EasementandSundryMembertpl:LandAndResourceManagementSegmentMember2022-01-012022-12-310001811074tpl:EasementandSundryMembertpl:WaterServiceandOperationsSegmentMember2022-01-012022-12-310001811074tpl:LandSalesMembertpl:LandAndResourceManagementSegmentMember2024-01-012024-12-310001811074tpl:LandSalesMembertpl:WaterServiceandOperationsSegmentMember2024-01-012024-12-310001811074tpl:LandSalesMembertpl:LandAndResourceManagementSegmentMember2023-01-012023-12-310001811074tpl:LandSalesMembertpl:WaterServiceandOperationsSegmentMember2023-01-012023-12-310001811074tpl:LandSalesMembertpl:LandAndResourceManagementSegmentMember2022-01-012022-12-310001811074tpl:LandSalesMembertpl:WaterServiceandOperationsSegmentMember2022-01-012022-12-310001811074tpl:LandAndResourceManagementSegmentMember2024-01-012024-12-310001811074tpl:WaterServiceandOperationsSegmentMember2024-01-012024-12-310001811074tpl:LandAndResourceManagementSegmentMember2023-01-012023-12-310001811074tpl:WaterServiceandOperationsSegmentMember2023-01-012023-12-310001811074tpl:LandAndResourceManagementSegmentMember2022-01-012022-12-310001811074tpl:WaterServiceandOperationsSegmentMember2022-01-012022-12-310001811074tpl:LandAndResourceManagementSegmentMember2024-12-310001811074tpl:LandAndResourceManagementSegmentMember2023-12-310001811074tpl:WaterServiceandOperationsSegmentMember2024-12-310001811074tpl:WaterServiceandOperationsSegmentMember2023-12-310001811074us-gaap:SubsequentEventMember2025-02-182025-02-180001811074srt:OilReservesMember2021-12-310001811074srt:NaturalGasReservesMember2021-12-310001811074srt:NaturalGasLiquidsReservesMember2021-12-310001811074srt:OilReservesMember2022-01-012022-12-310001811074srt:NaturalGasReservesMember2022-01-012022-12-310001811074srt:NaturalGasLiquidsReservesMember2022-01-012022-12-310001811074srt:OilReservesMember2022-12-310001811074srt:NaturalGasReservesMember2022-12-310001811074srt:NaturalGasLiquidsReservesMember2022-12-310001811074srt:OilReservesMember2023-01-012023-12-310001811074srt:NaturalGasReservesMember2023-01-012023-12-310001811074srt:NaturalGasLiquidsReservesMember2023-01-012023-12-310001811074srt:OilReservesMember2023-12-310001811074srt:NaturalGasReservesMember2023-12-310001811074srt:NaturalGasLiquidsReservesMember2023-12-310001811074srt:OilReservesMember2024-01-012024-12-310001811074srt:NaturalGasReservesMember2024-01-012024-12-310001811074srt:NaturalGasLiquidsReservesMember2024-01-012024-12-310001811074srt:OilReservesMember2024-12-310001811074srt:NaturalGasReservesMember2024-12-310001811074srt:NaturalGasLiquidsReservesMember2024-12-310001811074srt:OilReservesMember2024-01-012024-12-310001811074srt:OilReservesMember2023-01-012023-12-310001811074srt:OilReservesMember2022-01-012022-12-310001811074srt:NaturalGasReservesMember2024-01-012024-12-310001811074srt:NaturalGasReservesMember2023-01-012023-12-310001811074srt:NaturalGasReservesMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to ______

Commission File Number: 1-39804

Exact name of registrant as specified in its charter:

Texas Pacific Land Corporation

| | | | | | | | |

| State or other jurisdiction of incorporation or organization: | | IRS Employer Identification No.: |

| Delaware | | 75-0279735 |

Address of principal executive offices:

1700 Pacific Avenue, Suite 2900 Dallas, Texas 75201

Registrant’s telephone number, including area code:

(214) 969-5530

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock

(par value $.01 per share) | TPL | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check One)

| | | | | | | | | | | |

| Large Accelerated Filer | þ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| Emerging growth company | ¨ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant as of the last business day (June 28, 2024) of the registrant’s most recently completed second fiscal quarter (June 30, 2024) was approximately $10.9 billion.

As of February 12, 2025, there were 22,984,798 shares of the registrant’s common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

TEXAS PACIFIC LAND CORPORATION

TABLE OF CONTENTS

PART I

Statements in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements regarding management’s expectations, hopes, intentions or strategies regarding the future. Words or phrases such as “expects” and “believes,” or similar expressions or the negative of such terms, when used in this Annual Report on Form 10-K or other filings with the Securities and Exchange Commission (the “SEC”), are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding the Company’s future operations and prospects, the markets for real estate in the areas in which the Company owns real estate, applicable zoning regulations, the markets for oil and gas including actions of other oil and gas producers or consortiums worldwide such as the Organization of Petroleum Exporting Countries (“OPEC”) and Russia (collectively referred to as “OPEC+”), expected competition, management’s intent, beliefs or current expectations with respect to the Company’s future financial performance and other matters. All forward-looking statements in this Report are based on information available to us, and speak only, as of the date this Report is filed with the SEC, and we assume no responsibility to update any such forward-looking statements, except as required by law. All forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, the factors discussed in Part I, Item 1A. “Risk Factors” and Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Item 1. Business.

General

Texas Pacific Land Corporation (which, together with its subsidiaries as the context requires, may be referred to as “TPL,” the “Company,” “our,” “we,” or “us”) is a Delaware Corporation and one of the largest landowners in the State of Texas with approximately 873,000 surface acres of land, principally concentrated in the Permian Basin. Additionally, we own a 1/128th nonparticipating perpetual oil and gas royalty interest (“NPRI”) under approximately 85,000 acres of land, a 1/16th NPRI under approximately 371,000 acres of land, and approximately 16,000 additional net royalty acres (normalized to 1/8th) (“NRA”), for a collective total of approximately 207,000 NRA, principally concentrated in the Permian Basin.

The Company was originally organized as Texas Pacific Land Trust (the “Trust”) under a Declaration of Trust, dated February 1, 1888 (the “Declaration of Trust”), to receive and hold title to extensive tracts of land in the State of Texas, previously the property of the Texas and Pacific Railway Company. The Declaration of Trust provided for the appointment of trustees (the “Trustees”) to manage the assets of the Trust with all of the powers of an absolute owner. On January 11, 2021, the Trust completed its reorganization from a business trust, Texas Pacific Land Trust, into Texas Pacific Land Corporation, a corporation formed and existing under the laws of the State of Delaware (“the “Corporate Reorganization”).

Our surface and royalty ownership provide revenue opportunities throughout the oil and gas development value chain. While we are not an oil and gas producer, we benefit from various revenue sources throughout the life cycle of a well. During the initial development phase whereby infrastructure for oil and gas development is constructed, we receive fixed fee payments for use of our land and revenue for sales of materials (caliche) used in the construction of the infrastructure. During the drilling and completion phase, we generate revenue for providing sourced water and/or treated produced water, fixed fee payments for use of our land and revenue related to the sale of sand to operators. During the production phase, we receive revenue from our oil and gas royalty interests and revenue related to saltwater disposal on our land. In addition, we generate revenue from pipeline, power line and utility easements, commercial leases and temporary permits principally related to a variety of land uses, including, but not limited to, midstream infrastructure projects and processing facilities as hydrocarbons are processed and transported to market. Additionally, as a result of an acquisition in 2024, we have recently begun receiving commercial revenue related to a nonhazardous oilfield solids waste disposal site. See further discussion in Note 3, “Assets Acquired in a Business Combination” in the notes to our consolidated financial statements included under Part II, Item 8. “Financial Statements and Supplementary Data.”

Our mission is to pursue a thoughtful, long-term approach towards optimizing and building upon the commercial and environmental virtues of our extensive lands and resources. We have a long history of responsible management of our legacy assets, and in recent years, we have expanded our business strategy to generate incremental revenue streams that take advantage of our vast surface and royalty footprint, such as our investments in the Water Services and Operations business segment. Beyond our current businesses, we continue to explore new opportunities related to renewable energy, environmental

sustainability, and technology, among others, that can leverage our existing legacy surface and royalty assets. Our business model emphasizes high cash flow margins and relatively low ongoing capital expenditure requirements, and we expect new opportunities to generally align with these priorities. We remain focused on optimizing long-term value creation and profitability, fostering responsible stewardship of our assets, providing quality customer service, and engaging with and advocating for employee and stakeholder interests.

Recent Developments

Common Stock Split

On March 26, 2024, we effected a three-for-one stock split in the form of a stock dividend of two additional shares of common stock, par value $0.01 per share (“Common Stock”), for every share of Common Stock outstanding to stockholders of record as of March 18, 2024. All shares, restricted stock awards (“RSAs”), restricted stock units (“RSUs”), performance stock units (“PSUs”) and per share information have been retroactively adjusted to reflect the stock split. The shares of Common Stock retained a par value of $0.01 per share. Accordingly, an amount equal to the par value of the increased shares resulting from the stock split was reclassified from “Additional paid-in capital” to “Common Stock” on our consolidated balance sheets.

Acquisition Activity During 2024

In August 2024, we acquired 4,120 surface acres in Martin, County, Texas along with other surface-related tangible and intangible assets from an unaffiliated seller, for total cash consideration of $45.0 million, of which $20.4 million represented assets acquired for the Land and Resource Management segment with the remaining $24.6 million of assets acquired for the Water Services and Operations segment. In addition to surface acres, we acquired water sourcing assets and other contractual rights including a contractual right to a 7.5% royalty on revenue generated from a nonhazardous oilfield solids waste disposal site. These assets generate revenue streams across both segments including water sales, produced water royalties, and other surface related (“SLEM”) revenue and provide additional commercial growth opportunities for us to expand water sourcing and produced water opportunities to both new and existing customers. See further discussion of this acquisition in Note 3, “Assets Acquired in a Business Combination” in the notes to our consolidated financial statements included under Part II, Item 8. “Financial Statements and Supplementary Data.”

Also in August 2024, we acquired mineral interests across 4,106 NRA located in Culberson County, Texas for a purchase price of $120.3 million, net of post-closing adjustments. The acquisition was completed in conjunction with Brigham Royalties Fund I Holdco, L.L.C., a subsidiary of Brigham Royalties, LLC (“Brigham Royalties”) in an arms-length transaction with an unaffiliated seller. See further discussion of this acquisition in Note 4, “Oil and Gas Royalty Interests” in the notes to our consolidated financial statements included under Part II, Item 8. “Financial Statements and Supplementary Data.” The acquired mineral interests overlap with existing TPL royalty acreage.

In October 2024, we acquired 7,490 NRA located primarily in the Midland Basin in Martin, Midland and other counties in Texas and New Mexico, with over 80% of the acquired interests adjacent to or overlapping existing TPL surface and royalty acreage for cash consideration of $275.2 million, net of post-closing adjustments.

Business Segments

We operate our business in two reportable segments: Land and Resource Management and Water Services and Operations. Our segments provide management with a comprehensive financial view of our key businesses. Our segments enable the alignment of strategies and objectives of the Company and provide a framework for timely and rational allocation of resources within businesses. See Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 15, “Business Segment Reporting” in the notes to our consolidated financial statements included under Part II, Item 8. “Financial Statements and Supplementary Data.”

Land and Resource Management

Our Land and Resource Management segment encompasses the business of managing our approximately 873,000 surface acres of land and approximately 207,000 NRA of oil and gas royalty interests, principally concentrated in the Permian Basin. The revenue streams of this segment consist primarily of royalties from oil and gas, revenues from easements, commercial leases and renewables, and land and material sales.

We are not an oil and gas producer. Rather, our oil and gas revenue is derived from our oil and gas royalty interests. Thus, in addition to being subject to fluctuations in response to the market prices for oil and gas, our oil and gas royalties are

also subject to decisions made by the owners and operators of the oil and gas wells to which our royalty interests relate as to investments in and production from those wells. Our oil and gas royalty interests require no capital expenditures or operating expense burden from us for well development.

Our revenue from easements is primarily generated from pipelines transporting oil, gas and related hydrocarbons, power line and utility easements, and subsurface wellbore easements. Easements typically have a 30-plus year term but subsequently renew every 10 years with an additional payment. In addition to easements, we also receive revenues from other surface-related operations on our land, including but not limited to, commercial leases, well development and material sales. Commercial lease revenue is derived primarily from processing, storage and compression facilities, and roads. Material sales include caliche, sand, and other material sales to operators. Caliche is used in the construction of oil and gas-related infrastructure, and sand is utilized for completion operations. Additionally, as a result of an acquisition in 2024, we have recently begun generating commercial revenue related to a nonhazardous oilfield solids waste disposal site. See the discussion of acquisition activity above for additional information.

In recent years, we have entered into agreements with third parties related to renewables and various “next generation” opportunities that will potentially utilize TPL’s surface assets. These agreements include the evaluation of grid-connected batteries, studies on carbon capture and sequestration, and development of bitcoin mining facilities, among other opportunities. Generally, these projects are structured with multi-year terms that allow for feasibility and/or commercial suitability and revenue arrangements that provide royalty, fee, profit sharing, lease and/or rental payments, though contractual terms and timing for commercial operations will vary by project. We do not anticipate these agreements will have a significant impact on our revenues in the short-term but do have the potential to contribute meaningfully to our revenues in the longer term.

As a significant landowner, we also generate revenue from land sales. From time to time, we receive offers from third parties to acquire tracts of our land. Sales demand and related sale prices of particular tracts of land are influenced by many factors, including general economic conditions, the rate of development in nearby areas and the suitability of the particular tract for commercial uses.

Operations

Revenues from the Land and Resource Management segment for the last three years were as follows (dollars presented in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

| | 2024 | | 2023 | | 2022 |

| | Segment

Revenue | | % of Total

Consolidated

Revenue | | Segment

Revenue | | % of Total

Consolidated

Revenue | | Segment

Revenue | | % of Total

Consolidated

Revenue |

| Oil and gas royalties | $ | 373,331 | | | 53 | % | | $ | 357,394 | | | 57 | % | | $ | 452,434 | | | 68 | % |

| Easements and other surface-related income | 63,074 | | | 9 | % | | 67,905 | | | 11 | % | | 44,860 | | | 7 | % |

| Land sales | 4,388 | | | 1 | % | | 6,806 | | | 1 | % | | 9,681 | | | 1 | % |

| Total Revenue – Land and Resource Management segment | $ | 440,793 | | | 63 | % | | $ | 432,105 | | | 69 | % | | $ | 506,975 | | | 76 | % |

See Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Segment Results of Operations” for a discussion of our segment-level financial results.

Oil and Gas Activity for the Year Ended December 31, 2024

For the year ended December 31, 2024, our share of crude oil, natural gas and natural gas liquid (“NGL”) production was 26.8 thousand barrels of oil equivalent (“Boe”) per day compared to 23.5 thousand Boe per day for the same period of 2023. The average realized price was $39.87 per Boe for the year ended December 31, 2024, a decrease of 6.4% compared to the average realized price of $42.58 per Boe for the same period of 2023.

There are a number of oil and gas wells in which we have royalty interests that have been permitted but are still awaiting drilling and completion activity. In addition, we have also identified oil and gas wells in which we have a royalty interest that have been drilled but are not yet completed (“DUC”). These permitted and DUC wells represent potential near-term

candidates for further development by operators towards ultimately being placed into production. We have identified 506 permitted gross wells (an estimated 6.4 net wells) and 793 DUC wells (an estimated 13.2 net wells) subject to our royalty interest as of December 31, 2024. The number of DUC wells is determined using uniform drilling spacing units with pooled interests for all wells awaiting completion.

Competition

Our Land and Resource Management segment has few direct peers, in that it sells, leases and generally manages land owned by the Company and, as such, any owner of property located in areas comparable to the Company is a potential competitor. The Company’s sizable land ownership of approximately 873,000 surface acres and commercial sophistication is unique, as neighboring landowners tend to own substantially smaller land positions and/or do not possess the commercial expertise to maximize business opportunities.

Water Services and Operations

Our Water Services and Operations segment encompasses the business of providing full-service water offerings to operators in the Permian Basin through our wholly-owned subsidiary, Texas Pacific Water Resources LLC (“TPWR”).

These full-service water offerings include, but are not limited to, water sourcing, produced-water treatment, infrastructure development, and disposal solutions. We are committed to sustainable water development. Our significant surface ownership in the Permian Basin provides TPWR with a unique opportunity to provide multiple full-service water offerings to operators.

The revenue streams of this segment principally consist of revenue from sales of sourced and treated water as well as revenue from produced water royalties. Energy businesses use water for their oil and gas projects, including new drilling and completion operations, while service businesses (i.e., water management service companies) operate water facilities to sell water to, and dispose of produced water of, energy businesses.

Operations

Revenues from our Water Services and Operations segment for the last three years were as follows (dollars presented in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

| | 2024 | | 2023 | | 2022 |

| | Segment

Revenue | | % of Total

Consolidated

Revenue | | Segment

Revenue | | % of Total

Consolidated

Revenue | | Segment

Revenue | | % of Total

Consolidated

Revenue |

| Water sales | $ | 150,724 | | | 21 | % | | $ | 112,203 | | | 18 | % | | $ | 84,725 | | | 13 | % |

| Produced water royalties | 104,123 | | | 15 | % | | 84,260 | | | 13 | % | | 72,234 | | | 11 | % |

| Easements and other surface-related income | 10,183 | | | 1 | % | | 3,027 | | | — | % | | 3,488 | | | — | % |

| Total Revenue – Water Services and Operations segment | $ | 265,030 | | | 37 | % | | $ | 199,490 | | | 31 | % | | $ | 160,447 | | | 24 | % |

See Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Segment Results of Operations” for a discussion of our segment-level operating results.

Activity for the year ended December 31, 2024

The increase in water sales during 2024 compared to 2023 is principally due to a 31.0% increase in water sales volumes over the same period.

In May 2024, we announced our progress towards developing new solutions for produced water in the Permian Basin. Over the last few years, we have been working with a leading industrial technology and manufacturing firm to develop an energy-efficient desalination and treatment process and associated equipment that can recycle produced water into fresh water with quality standards appropriate for surface discharge and beneficial reuse. With the Permian Basin generating approximately 19 million barrels of produced water per day, we believe this technology would provide an attractive and critical alternative to

subsurface injection. We filed a patent application for the desalination and treatment process and have secured exclusive use-rights for the equipment geared towards produced water applications. We have successfully tested a pilot program in our research and development lab. Construction has begun on a sub-scale produced water desalination test facility with an initial capacity of 10,000 barrels of produced water per day, and we anticipate construction to be completed during 2025. We are also in commercial discussions with oil and gas upstream operators as we look to provide critical, technology-driven solutions while also optimizing our economic interests and limiting capital outlay. During the year ended December 31, 2024, we spent $9.9 million on this new energy-efficient desalination and treatment process and equipment, of which $7.4 million was capitalized.

Additionally, during 2024, we invested $21.7 million in TPWR projects to maintain and/or enhance water sourcing assets.

Competition

While there is competition in the water service business in the Permian Basin, we believe our position as a significant landowner of approximately 873,000 surface acres gives us a distinct advantage over our competitors who must negotiate with existing landowners to source water and then for the right of way to deliver the water to the end user.

Major Customers

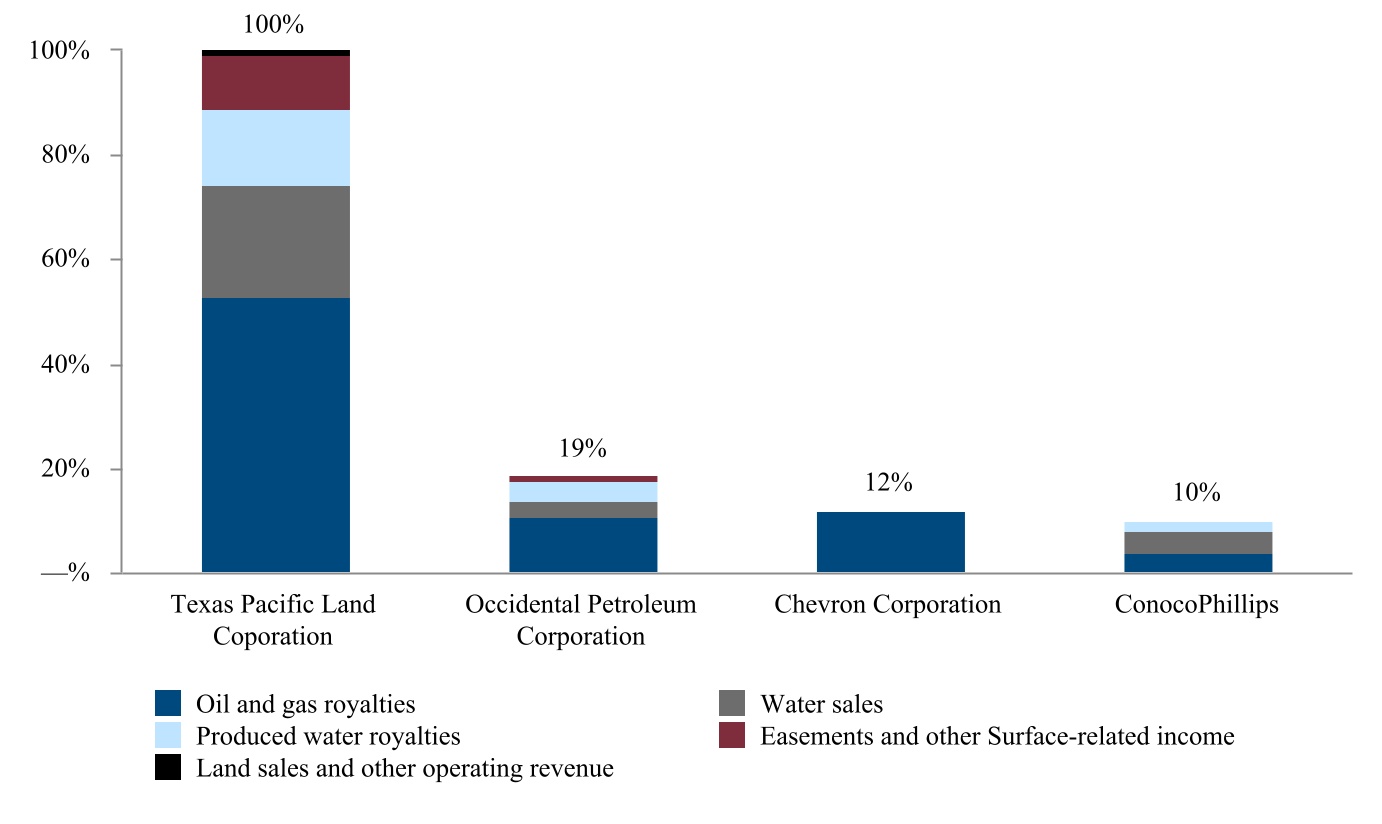

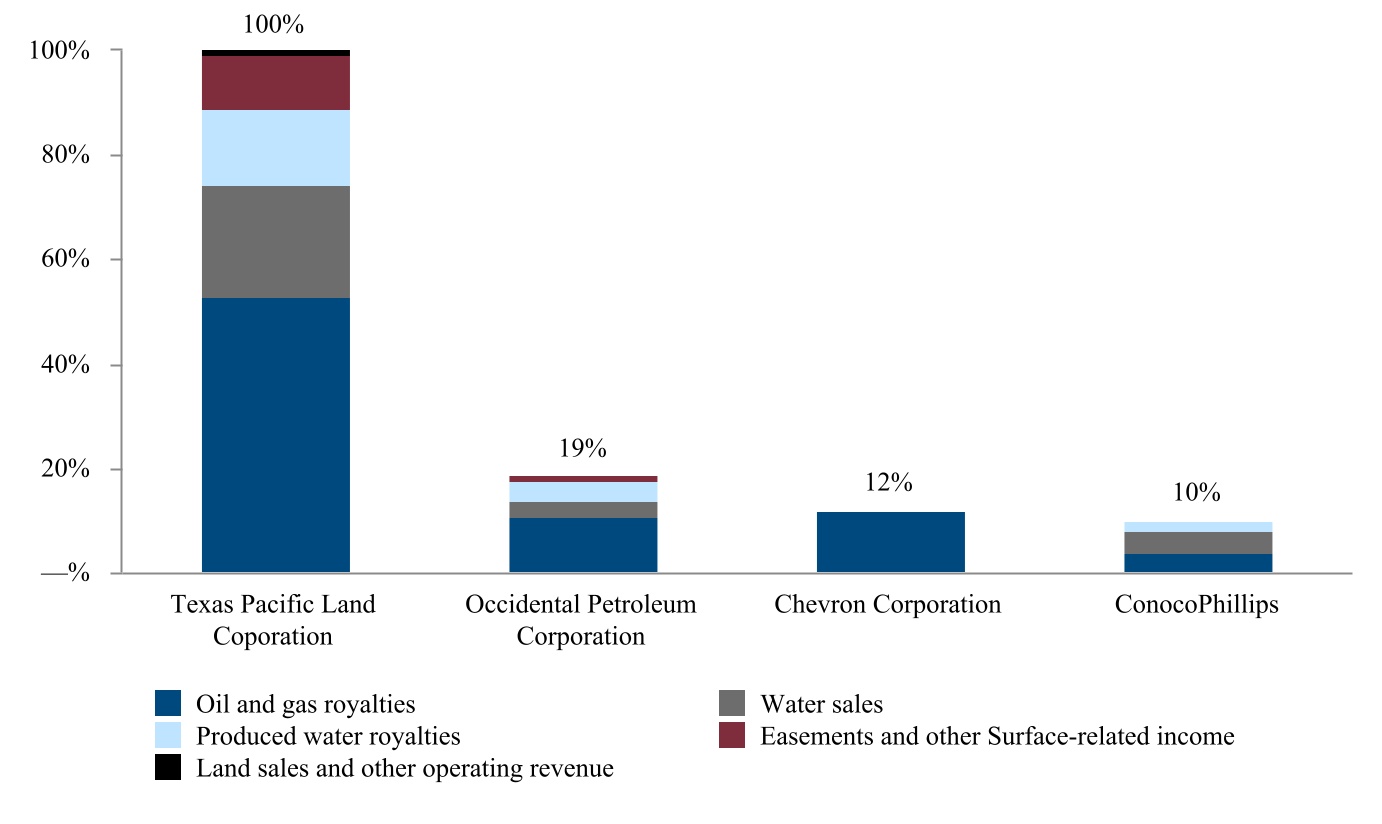

The chart below depicts our total revenues and revenues from customers representing 10% or more of our 2024 consolidated revenues:

While approximately 41% of our 2024 revenue was derived from only three customers, two of these customers are in the top 10, and the remaining customer is in the top 50, energy companies in the world based on market capitalization, and we believe each of them is a strong and reliable operator. Given their major presence in the Permian Basin and our significant surface lands in the same area, the high concentration of business with these three customers is expected. Further, the choice of whom we do business with largely depends on location of mineral royalties and surface rights on or near our assets and consists of a limited universe of oil and gas companies who operate in the Permian Basin.

Seasonality

While our business is not seasonal in nature, as that term is generally understood, revenue from oil and gas royalties may fluctuate from period to period based upon market prices for oil and gas and production decisions made by the operators. Our other revenue streams, which include, but are not limited to, water sales and royalties, easements and other surface related income and sales of land, may also fluctuate from period to period. In addition, our results are generally dependent on the decisions and actions of third parties out of our ultimate control. As a consequence, the results of our operations for any particular period are not necessarily indicative of the results of operations for a full year.

Regulations

We are subject to various federal, state and local laws. Management believes that our operations comply in all material respects with applicable laws and regulations and that the existence and enforcement of such laws and regulations have no more restrictive effect on our method of operations than on other companies similar to TPL.

We cannot determine the extent to which new legislation, new regulations or changes in existing laws or regulations may affect our future operations.

Environmental Considerations

Compliance with federal, state and local provisions that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, have had no material effect upon our business generally, including the capital expenditures, earnings and competitive position of the Company. To date, we have not been called upon to expend any material amount of funds for these purposes.

Environmental, Social and Governance (“ESG”)

Our current ESG disclosure is available at our website at www.TexasPacific.com. Our ESG disclosure has been prepared to align with the Sustainable Accounting Standards Board, the Global Reporting Initiative, and the Task Force on Climate Related Disclosures frameworks.

Integrating sustainability and ESG objectives is a priority for our Company. Our ESG strategy reflects its dedication to meeting tactical business priorities while managing the environmental impacts of its operations, maintaining principles for social responsibility, and upholding a commitment to strong corporate governance. Our ESG strategy is focused on the overarching priorities of environmental management, employee health and safety, workforce management and equality, community and landowner engagement, and strong corporate governance and ethics. We are committed to sustainability and responsible stewardship across all of our operations and land management activities.

As we do not produce oil or gas from the land from which our royalty revenue stream is derived, we developed our sustainability goals and partnership opportunities in consultation with the entities operating on our land. On the water solutions side of our business, we developed a tailored ESG program that addresses the ethical and responsible buildout of water assets and management of water as a natural resource. Our continued goal is an integrated and iterative approach to sustainable and responsible resource management.

Our ESG accomplishments include, but are not limited to:

•Increased the electrification of our water assets in an effort to reduce costs and mitigate our overall emission profile by reducing reliance on diesel generators. Cumulatively through December 31, 2024, we have spent $22.3 million of capital on electric infrastructure.

•Initiated energy tracking in 2020 to monitor and identify trends in energy consumption and sourcing.

•Prioritized the health and welfare of our workforce.

•Employed practices for the tracking and monitoring of all spills, regardless of whether they are within or outside of regulatory reporting requirements. We had zero spills of produced water in 2024, 2023, and 2022.

•Partnered with oil & gas operators on our surface estate to collectively discuss and manage ESG risks. Partnership opportunities included: developing renewable energy infrastructure across our land, developing water infrastructure to

support the reuse and recycling of produced water—a critical response to climate change, partnering to develop new technologies that support emissions management, and more.

•Instituted a governance framework that includes oversight and stewardship of our ESG strategies. The Nominating and Corporate Governance Committee (the “Nominating and Corporate Governance Committee”) of our board of directors (“the Board”) reviews our policies and programs concerning corporate social responsibility, including ESG matters, with the support of the Audit Committee of the Board (“the “Audit Committee”) and the Compensation Committee of the Board (the “Compensation Committee”), where appropriate. The committees provide guidance to the Board and management with respect to trends and developments regarding environmental, social, governance, and political matters that could significantly impact the Company.

The disclosure denotes that our ESG strategy, including metrics and targets, is continuously reviewed and assessed annually to determine if updates or process improvements are needed.

Human Capital Resources

We believe we have a talented, motivated and dedicated team, and we are committed to supporting the development of our team members and continuously building on our strong culture. As of December 31, 2024, we had 111 full-time employees, of which 34 were employees of TPWR.

Our business strategy and ability to serve customers relies on employing talented professionals and attracting, training, developing and retaining a knowledgeable skilled workforce. We maintain a good working relationship with our employees. We value our employees and their experience in providing value through land, mineral and water resource management and water solutions. Maintaining a robust pipeline of talent is crucial to our ongoing success and is a key aspect of succession planning efforts across the organization. Our leadership and human resources teams are responsible for attracting and retaining top talent by facilitating an environment where employees feel supported and encouraged in their professional and personal development. We are committed to enhancing gender, racial and ethnic diversity throughout our organization. We believe that diversity is an important factor in bringing people together, encouraging shared commitment and fostering new ideas.

We strive to be a great place for our employees to work. Accordingly, we offer industry competitive pay and benefits, tuition reimbursement and continuing education classes and are committed to maintaining a workplace environment that promotes employee productivity and satisfaction.

Employee safety is also among our top priorities. Accordingly, we have developed and administer company-wide policies to ensure a safe and fair workplace free of discrimination or harassment for each team member and compliance with Occupational Safety and Health Administration (“OSHA”) standards, as further discussed in our Code of Business Conduct and Ethics. This commitment applies to recruiting, hiring, compensation, benefits, training, termination, promotions or any other terms and conditions of employment. We maintain our strong focus on safety and have taken measures to protect our employees and maintain safe, reliable operations.

We have a goal of zero occupational injuries, illnesses and incidents in our workplace. To ensure that we protect our safety culture, we have in place a dedicated Health, Safety, and Environment Management team with substantial combined years of experience and have in-house authorized trainers for OSHA-required certified training, powered equipment training and PCE-safe land certificated training.

Available Information on our Website

We make available on our website at www.TexasPacific.com, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”). Such reports are also available at www.sec.gov. The information contained on our website is not part, or incorporated by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors.

An investment in our securities involves a degree of risk. The risks described below, and other risks noted throughout this Annual Report on Form 10-K, including those risks identified in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also have a material adverse effect on us. If any of the following risks actually occur, our financial condition, results of operations, cash flows or business could be harmed. In that case, the market price of our stock could decline and you could lose part or all of your investment in our stock.

Risks Related to Our Business

Our oil and gas royalties are dependent upon the market prices of oil and gas which fluctuate.

The oil and gas royalties that we receive are dependent upon the market prices for oil and gas, and decreases in such prices for oil and gas negatively impact the revenue realized on our oil and gas royalties. Reductions in market prices for oil and gas could also lead to decreased exploration and development activity by the operators of the properties on which we own oil and gas royalty interests, which could reduce our revenue potential with respect to such interests. Market prices for oil and gas are subject to US and global macroeconomic and geopolitical conditions and infrastructure and logistical constraints, amongst others, and, in the past, have been subject to significant price fluctuations. Price fluctuations for oil and gas have been particularly volatile in recent years due to supply and demand constraints, worldwide energy conservation measures, OPEC and OPEC+ actions, global conflicts in major oil producing regions, especially in Eastern Europe and the Middle East, and general economic cycles, among other factors. These events and conditions have, at times, resulted in a reduction of global economic activity and volatility in the global financial markets. The scale and duration of the impact of these factors remain unknowable but could lead to a decrease in our revenues and have a material impact on our business segments and earnings, cash flow and financial condition.

We are not an oil and gas producer. Our revenues from oil and gas royalties are subject to the actions of others.

We are not an oil and gas producer. Our oil and gas royalty revenue is derived primarily from perpetual non-participating oil and gas royalty interests that we have retained or acquired. As oil and gas wells age, their production capacity may decline absent additional investment. However, the owners and operators of the oil and gas wells make all decisions as to investments in, and production from, those wells and our royalties are dependent upon decisions made by those owners and operators, among other factors. Accordingly, a significant portion of our revenues is reliant on the management and actions of third parties, over whom we have no control. Such third parties may not take actions or make decisions that will be beneficial to us, which could result in adverse effects on our financial results and performance.

Our revenues from the sale of land are subject to substantial fluctuation. Land sales are subject to many factors that are beyond our control.

Our land sales vary widely from year to year and quarter to quarter. The total price obtained, the average price per acre, and the number of acres sold in any one year or quarter should not be assumed to be indicative of future land sales. Our desire to sell and the demand and pricing for any particular tract of our land is influenced by many factors, including but not limited to: (i) access and location, (ii) the national and local economies, (iii) the rate of oil and gas well development by operators, (iv) the rate of development in nearby areas, (v) the livestock carrying capacity, and (vi) the condition of the local industries, which itself is influenced by a range of conditions. Our ability to sell land can be, therefore, largely dependent on the actions of adjoining landowners.

Demand for TPWR’s products and services is substantially dependent on the levels of expenditures by our customers.

Demand for TPWR’s products and services is substantially dependent on demand and expenditures by our customers for the exploration, development and production of oil and natural gas reserves. These expenditures are generally dependent on our customers’ overall financial position, capital allocation priorities, and views of future oil and natural gas prices. Declines, as well as anticipated declines, in oil and gas prices have in the past resulted, and may in the future result, in lower capital expenditures, project modifications, delays or cancellations, general business disruptions, and delays in payment, or nonpayment, of amounts that are owed to us, which could in the future, adversely affect our earnings, cash flow and financial condition. The results of operations for the Water Services and Operations segment have been impacted from time to time by reduced development pacing and declines in expenditures by our customers in response to varying industry or global circumstances. Our results may continue to be impacted by producer discretion on development pacing and capital expenditures.

We face the risks of doing business in a new and rapidly evolving market for TPWR and may not be able to successfully address such risks and achieve acceptable levels of success or profits.

We have encountered and may continue to encounter the challenges, uncertainties and difficulties frequently experienced in new and rapidly evolving markets with respect to the business of TPWR, including, but not limited to:

•pricing pressure driven by new competition;

•volatile and/or unexpected operating and maintenance costs;

•lack of sufficient customers or loss of significant customers for the new line of business;

•increased regulation, including with respect to environmental and geological uses and impacts on industry operations; and

•uncertainty regarding outsourced third-parties providing water treatment services.

The impact of government regulation on TPWR could adversely affect our business.

The business of TPWR is subject to applicable state and federal laws and regulations, including laws and regulations on water use, environmental and safety matters. These laws and regulations may increase the costs and timing of planning, designing, drilling, installing, operating and abandoning water wells and sourced water and treatment facilities and impact our customers’ ability to transport, store and/or dispose of produced water in certain locations. Due to increased seismicity in the Delaware and Midland Basins, the Texas Railroad Commission recently began implementing seismic response areas (“SRAs”) limiting the permitted capacity and use of certain saltwater disposal wells (“SWDs”) for the injection of produced water. The implementation of SRAs could limit the volume of produced water disposed on the Company’s surface within the SRAs or, in certain cases, could direct additional volumes of produced water to SWDs on the Company’s surface outside of SRAs. These limitations and/or redirections may require TPWR to adapt its business plans and could affect TPWR’s financial performance. We continue to actively engage with the Texas Railroad Commission and evaluate the potential effect of SRAs on our produced water royalties.

Our estimated proved developed producing reserves are based on many assumptions that may prove to be inaccurate. Any inaccuracies in these estimates or underlying assumptions may materially affect the quantities and present value of our reserves.

It is not possible to measure underground accumulations of oil, natural gas, and NGL with precision. Oil and natural gas reserve engineering requires subjective estimates of underground accumulations of oil and natural gas and assumptions concerning future oil and natural gas prices, production levels, ultimate recoveries and operating and development costs. In estimating our proved developed producing (“PDP”) reserves, we and Ryder Scott Company, L.P. ("Ryder Scott"), an independent third-party petroleum engineering firm, must make various assumptions with respect to many matters that may prove to be incorrect, including:

•future oil, natural gas, and NGL prices;

•unexpected complications from offset well development;

•production rates;

•reservoir pressures, decline rates, drainage areas and reservoir limits;

•interpretation of subsurface conditions including geological and geophysical data;

•potential for water encroachment or mechanical failures;

•levels and timing of capital expenditures, lease operating expenses, production taxes and income taxes, and availability of funds for such expenditures; and

•effects of government regulation.

If any of these assumptions prove to be incorrect, our estimates of PDP reserves, the classifications of reserves based on risk of recovery and our estimates of the future net cash flows from our reserves could change significantly.

Our historical estimates of proved, developed and producing reserves and related valuations as of December 31, 2024 were prepared by Ryder Scott, which conducted a well-by-well review of all wells in which we have a mineral or royalty interest for the period covered by its reserve report using information provided by us. Over time, we may make material changes to reserve estimates. Some of our reserve estimates were made without the benefit of a lengthy production history, which are less reliable than estimates based on a lengthy production history. Our reserve estimates could differ materially from those reserve estimates of operators developing on our acreage. Numerous changes over time to the assumptions on which our reserve estimates are based, as described above, may result in the actual quantities of oil and natural gas that are ultimately recovered being different from our reserve estimates.

Cyber incidents or attacks targeting the systems and infrastructure used by us, our operators, other third parties with whom we do business or the oil and gas industry in general may adversely impact our operations, and if we are unable to obtain and maintain adequate protection of our data, our business may be adversely impacted.

We and our operators increasingly rely on information technology systems to operate our respective businesses, and the oil and gas industry depends on digital technologies in exploration, development, production, and processing activities. Our technologies, systems and networks, and those of the operators on our properties and our vendors, suppliers and other business partners, have in certain instances been, and may in the future become, the target of cyberattacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of proprietary, personal and other information, or other disruption of business activities. Even without a direct breach of our systems, cybersecurity attacks on such third parties could adversely impact our business and reputation. In addition, certain cyber incidents, such as surveillance, may remain undetected for some period of time.

While we utilize various systems, procedures and controls to mitigate exposure to cybersecurity attacks and prevent cybersecurity incidents, such systems, procedures and controls may be breached as a result of third-party action, employee error, third-party or employee malfeasance or otherwise. Globally, cybersecurity attacks are increasing in number, and the threat actors are increasingly organized and well financed, or at times supported by state actors. In addition, geopolitical tensions or conflicts may create a heightened risk of cybersecurity attacks. Because the techniques used to obtain unauthorized access or to sabotage systems change frequently, we may not be able to anticipate these techniques and implement adequate preventative or protective measures.

Our cyber liability insurance coverage may not be sufficient or may not be available in the future on acceptable terms, or at all. In addition, our cyber liability insurance policy may cover only a portion of losses incurred in investigating or remediating a cybersecurity incident, if at all, and may not cover all claims made against us. As cybersecurity threats continue to evolve, we may be required to expend additional resources to continue to modify or enhance our protective measures or to investigate and remediate any vulnerability to cyber incidents. Any actual or perceived cybersecurity incident could adversely affect our business, financial position or results of operations.

The loss of key members of our management team or difficulty attracting and retaining experienced technical personnel could reduce our competitiveness and prospects for future success.

The successful implementation of our strategies and handling of other issues integral to our future success depends, in part, on our experienced management team, including with respect to the business of TPWR. The loss of key members of our management team could have an adverse effect on our business. If we cannot retain our experienced personnel or attract additional experienced personnel, our ability to compete within our industry could be harmed.

We face direct and indirect supply chain risks that may adversely affect our business.

Our business could be negatively affected by supply shortages and/or price increases driven by the increased costs of materials and logistics as a result of macroeconomic conditions, including geopolitical conflicts, general inflationary pressures, labor shortages, part or equipment availability, manufacturing capacity, tariffs, trade disputes and barriers, natural disasters or pandemics and the effects of climate change. Supply shortages and/or price increases could lead to a reduction in revenues and an increase in our operating costs, which would have a material impact on our business segments and earnings, cash flow and financial condition.

Supply chain issues may disrupt the operations and development activities of operators on our land, upon whom a significant portion of our revenue relies, which could negatively affect our revenues from oil and gas royalties, easements and

our water offerings. Supply chain issues could also lead to an increase in TPWR’s operating costs and disrupt its water sourcing and treatment operations, which could further negatively affect our revenues from our water offerings. TPWR has adapted lead times for ordering parts and equipment to mitigate supply chain issues in the past and will use its best efforts to adapt to additional supply chain issues in the future, but given the uncertainty surrounding the macroeconomic factors and geopolitical situation, supply chain issues may negatively affect our business operations in the future.

A third party has refused to continue to fulfill its obligations under existing arrangements to which the Trust was a party in connection with the completion of our Corporate Reorganization, and thereby may cause us to lose certain benefits that the Trust historically received.

The completion of the Corporate Reorganization implicated conditions and covenants contained in certain agreements to which the Trust was, and now TPL Corporation is, a party and thereby may cause us to lose certain benefits that the Trust historically received. For example, the obligation to pay ad valorem taxes with respect to certain of our royalty interests was assumed by a third party and is now the obligation of the successors in interest to such third party (the “obligors”), so long as such royalty interests are held by the Trustees or their successors in office under the Declaration of Trust. We have received an indication from one such obligor that it does not intend to continue to make ad valorem tax payments related to historical royalty interests. In order to protect the historical royalty interests from any potential tax liens for non-payment of ad valorem taxes, we have accrued and/or paid such ad valorem taxes since January 1, 2022. While we intend to seek reimbursement from the third party following payment of such taxes, there can be no assurance that we will be successful in getting reimbursed, and accordingly, no loss recovery receivable has been recorded as of December 31, 2024. Taking on the cost of such payments will have an adverse impact on our business and results of operations.

Risks Related to Our Common Stock

The market price of our Common Stock may fluctuate significantly.

The market price of our Common Stock may fluctuate significantly due to a number of factors, some of which may be beyond our control, including:

•actual or anticipated fluctuations in our results of operations due to factors related to our business;

•our quarterly or annual earnings, or those of other companies in our industry;

•changes to the regulatory and legal environment under which we operate;

•changes in accounting standards, policies, guidance, interpretations or principles;

•reports issued by securities analysts;

•changes in earnings estimates by securities analysts or our ability to meet those estimates;

•the operating and stock price performance of other comparable companies;

•investor perception of our Company and our industry;

•actual or anticipated fluctuations in commodities prices; and

•domestic and worldwide economic and geopolitical conditions.

The issuance of additional Common Stock in the future would dilute other stockholders.

Holders of our Common Stock could be diluted because of equity issuances for proposed acquisitions or capital market transactions or equity awards proposed to be granted to our directors, officers and employees subject to any required vote of holders of our Common Stock under our amended and restated certificate of incorporation and our amended and restated bylaws (“the Bylaws”). We may issue stock-based awards, including annual awards, new hire awards and periodic retention awards, as applicable, to our directors, officers and other employees under any employee benefits plans we have adopted or may adopt, using newly issued shares rather than treasury shares as is currently our practice.

In addition, our amended and restated certificate of incorporation authorizes us to issue, without the approval of our stockholders, one or more series of preferred stock having such designations, powers, preferences, privileges and relative,

participating, optional and special rights, and qualifications, limitations and restrictions as the Board may generally determine in its sole discretion. The terms of one or more classes or series of preferred stock could dilute the voting power or reduce the value of our Common Stock. For example, we could grant the holders of preferred stock the right to elect members of the Board or to veto specified transactions. Similarly, the repurchase or redemption rights or liquidation preferences that we could assign to holders of preferred stock could affect the residual value of our Common Stock.

We may not continue to pay dividends or to pay dividends at the same rate as previously paid.

The timing, declaration, amount of, and payment of any cash dividends to our stockholders is within the discretion of our Board and will depend upon many factors, including our financial condition, earnings, capital requirements of our operating subsidiaries, covenants associated with any debt service obligations or other contractual obligations, legal requirements, regulatory constraints, industry practice, ability to access capital markets and other factors deemed relevant by the Board. These factors could result in a change in our current dividend policy.

We will evaluate whether to repurchase our outstanding Common Stock in the future and we cannot guarantee the timing or amount of share repurchases, if any.

On November 1, 2022, our Board approved a stock repurchase program, which became effective January 1, 2023, to purchase up to an aggregate of $250.0 million of our outstanding Common Stock. During the year ended December 31, 2024, the Company repurchased 30,432 outstanding shares of Common Stock for an aggregate purchase price of $29.2 million, which repurchased shares were placed in treasury. The Company opportunistically repurchases stock under the stock repurchase program with funds generated by cash from operations. The stock repurchase program may be suspended from time to time, modified, extended or discontinued by the Board at any time. Any future repurchase under the stock repurchase program will be within the discretion of our Board and will depend upon many factors, including market and business conditions, the trading price of our Common Stock, available cash and cash flow, capital requirements and the nature of other investment opportunities.

State law and anti-takeover provisions could enable our Board to resist a takeover attempt by a third party and limit the power of our stockholders.

Our amended and restated certificate of incorporation, Bylaws and Delaware law contain provisions that are intended to deter coercive takeover practices and inadequate takeover bids and to encourage prospective acquirers to negotiate with our Board rather than to attempt a hostile takeover. These provisions include, among others: (a) the ability of our remaining directors to fill vacancies on our Board; (b) the ability of our Board to adopt, amend or repeal bylaws; (c) rules regarding how stockholders may present proposals or nominate directors for election at stockholder meetings; and (d) the right of our Board to issue preferred stock without stockholder approval.

In addition, we are subject to Section 203 of the Delaware General Corporation Law, as amended (“DGCL”), which could have the effect of delaying or preventing a change of control that you may favor. Section 203 provides that, subject to limited exceptions, persons that acquire, or are affiliated with persons that acquire, more than 15% of the outstanding voting stock of a Delaware corporation may not engage in a business combination with that corporation, including by merger, consolidation or acquisitions of additional shares, for a three-year period following the date on which that person or any of its affiliates becomes the holder of more than 15% of the corporation’s outstanding voting stock.

We believe these provisions protect our stockholders from coercive or otherwise unfair takeover tactics by requiring potential acquirers to negotiate with our Board and by providing our Board with more time to assess any acquisition proposal. These provisions are not intended to make the Company immune from takeovers; however, these provisions apply even if the offer may be considered beneficial by some stockholders and could delay or prevent an acquisition that our Board determines is not in the best interests of the Company and its stockholders. These provisions may also prevent or discourage attempts to remove and replace incumbent directors.

Our amended and restated certificate of incorporation designates the Court of Chancery of the State of Delaware or the U.S. District Court for the Northern District of Texas as the sole and exclusive forums for certain types of actions and proceedings that may be initiated by our stockholders, which could discourage lawsuits against the Company and our directors and officers.

Our amended and restated certificate of incorporation provides that unless the Company otherwise determines, the Court of Chancery of the State of Delaware (or, if such court does not have jurisdiction, any state or federal court residing within the State of Delaware) or the U.S. District Court for the Northern District of Texas in Dallas, Texas (or, if such court does not have jurisdiction, any district court in Dallas County in the State of Texas) will be the sole and exclusive forums for

any derivative action brought on our behalf, any action asserting a claim of breach of a fiduciary duty owed by any of our current or former directors, officers, employees or stockholders, any action or proceeding asserting a claim against us or any of our directors, officers, employees or agents arising pursuant to, or seeking to enforce any right, obligation or remedy under any provision of the DGCL, the laws of the State of Texas, the laws of the State of New York, our amended and restated certificate of incorporation or our Bylaws or any action asserting a claim against us or any of our directors, officers, employees or agents governed by the internal affairs doctrine, in each such case, subject to the applicable court having personal jurisdiction over the indispensable parties named as defendants in such action or proceeding. Our amended and restated certificate of incorporation also provides that unless our Board otherwise determines, the federal district courts of the United States will be the sole and exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933, as amended (the “Securities Act”).