Special Note Regarding This Presentation 1 SoftVest, L.P. (“SoftVest LP”) has filed a

definitive proxy statement (the “Proxy Statement”) with the United States Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for a special meeting of holders of the sub-share certificates of

proprietary interests (the “Shares”) for the election of a new trustee of Texas Pacific Land Trust (“TPL”) to fill the vacancy created by the resignation of Maurice Meyer III (such meeting, together with any adjournments, postponements or

continuations thereof, the “Special Meeting”). INVESTORS ARE STRONGLY ADVISED TO READ THE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION. Investors may obtain a free copy of the proxy statement, any amendments or supplements

thereto and other documents that SoftVest LP files with the SEC from the SEC’s website at sec.gov, or by contacting D.F. King, SoftVest LP’s proxy solicitor, by phone (212-269-5550) or e-mail (TPL@dfking.com).SoftVest Advisors, LLC,

SoftVest LP, Eric L. Oliver, ART-FGT Family Partners Limited, Tessler Family Limited Partnership, Allan R. Tessler, Horizon Kinetics LLC, Murray Stahl, Horizon Asset Management LLC, Kinetics Advisers, LLC, and Kinetics Asset Management

LLC may be deemed participants in the solicitation of proxies from holders of Shares in connection with the matters to be considered at the Special Meeting. Information about such participants’ direct and indirect interests, by security

holdings or otherwise, is contained in the Proxy Statement.

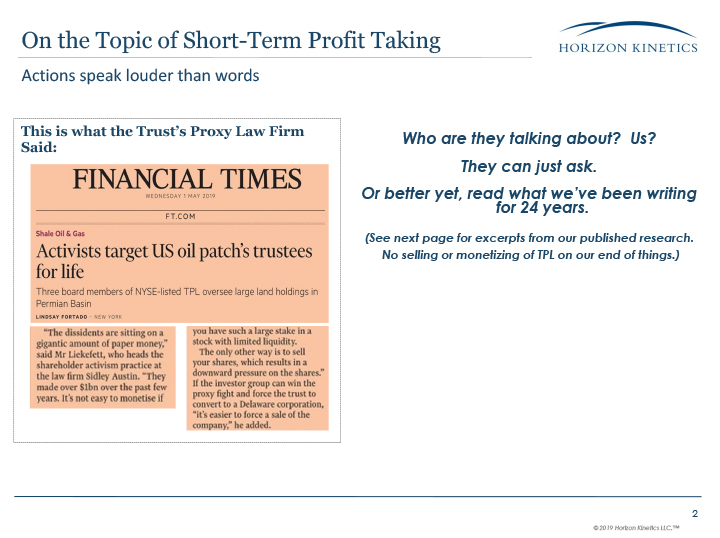

This is what the Trust’s Proxy Law Firm Said: On the Topic of Short-Term Profit Taking Actions

speak louder than words 2 Who are they talking about? Us?They can just ask. Or better yet, read what we’ve been writing for 24 years. (See next page for excerpts from our published research. No selling or monetizing of TPL on our end of

things.)

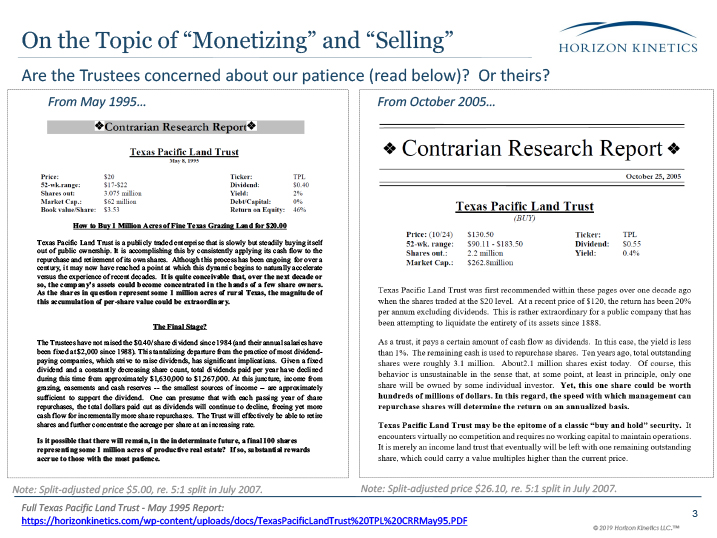

On the Topic of “Monetizing” and “Selling” Are the Trustees concerned about our patience (read

below)? Or theirs? 3 From May 1995… From October 2005… Note: Split-adjusted price $5.00, re. 5:1 split in July 2007. Note: Split-adjusted price $26.10, re. 5:1 split in July 2007. Full Texas Pacific Land Trust - May 1995 Report:

https://horizonkinetics.com/wp-content/uploads/docs/TexasPacificLandTrust%20TPL%20CRRMay95.PDF

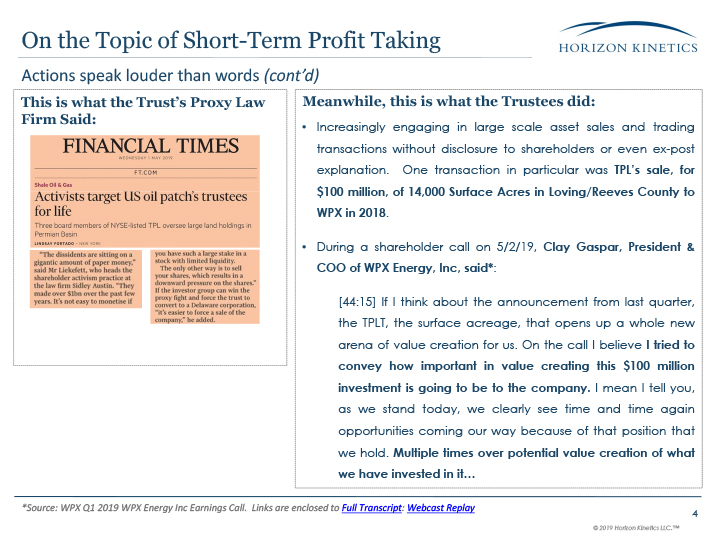

This is what the Trust’s Proxy Law Firm Said: Meanwhile, this is what the Trustees

did:Increasingly engaging in large scale asset sales and trading transactions without disclosure to shareholders or even ex-post explanation. One transaction in particular was TPL’s sale, for $100 million, of 14,000 Surface Acres in

Loving/Reeves County to WPX in 2018. During a shareholder call on 5/2/19, Clay Gaspar, President & COO of WPX Energy, Inc, said*:[44:15] If I think about the announcement from last quarter, the TPLT, the surface acreage, that opens up

a whole new arena of value creation for us. On the call I believe I tried to convey how important in value creating this $100 million investment is going to be to the company. I mean I tell you, as we stand today, we clearly see time and

time again opportunities coming our way because of that position that we hold. Multiple times over potential value creation of what we have invested in it… On the Topic of Short-Term Profit Taking Actions speak louder than words

(cont’d) 4 *Source: WPX Q1 2019 WPX Energy Inc Earnings Call. Links are enclosed to Full Transcript: Webcast Replay

This Presentation may include forward-looking statements that reflect the Participants’ current

views with respect to future events. Statements that include the words ‘‘expect,’’ ‘‘intend,’’ ‘‘plan,’’ ‘‘believe,’’ ‘‘project,’’ ‘‘anticipate,’’ ‘‘will,’’ ‘‘may,’’ ‘‘would’’ or similar words are often used to identify forward-looking

statements. All forward-looking statements address matters that involve risks and uncertainties, many of which are beyond our control. Accordingly, there are or will be important factors that could cause actual results to differ

materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Any forward-looking statements made in this Presentation are qualified in their entirety by these cautionary

statements, and there can be no assurance that the actual results or developments anticipated by the Participants will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the

Trust or its business, operations or financial condition. Except to the extent required by applicable law, the Participants undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new

information, future developments or otherwise.